Automatic Tax Receipt Donation Software

Stop manually generating tax receipts. Communal automatically issues official tax receipts instantly after every donation.

Instant tax receipts for every donation

Charities and registered nonprofits spend hours every week manually generating tax receipts. Communal eliminates this work entirely. When a donor gives, they instantly receive a professionally formatted tax receipt via email. No manual work, no delays, no errors. For Canadian charities, receipts are fully CRA-compliant.

- Automatic receipt generation within seconds of donation

- Compliant format with all required fields

- Custom branding with your organization's logo

- Sequential receipt numbers with complete audit trail

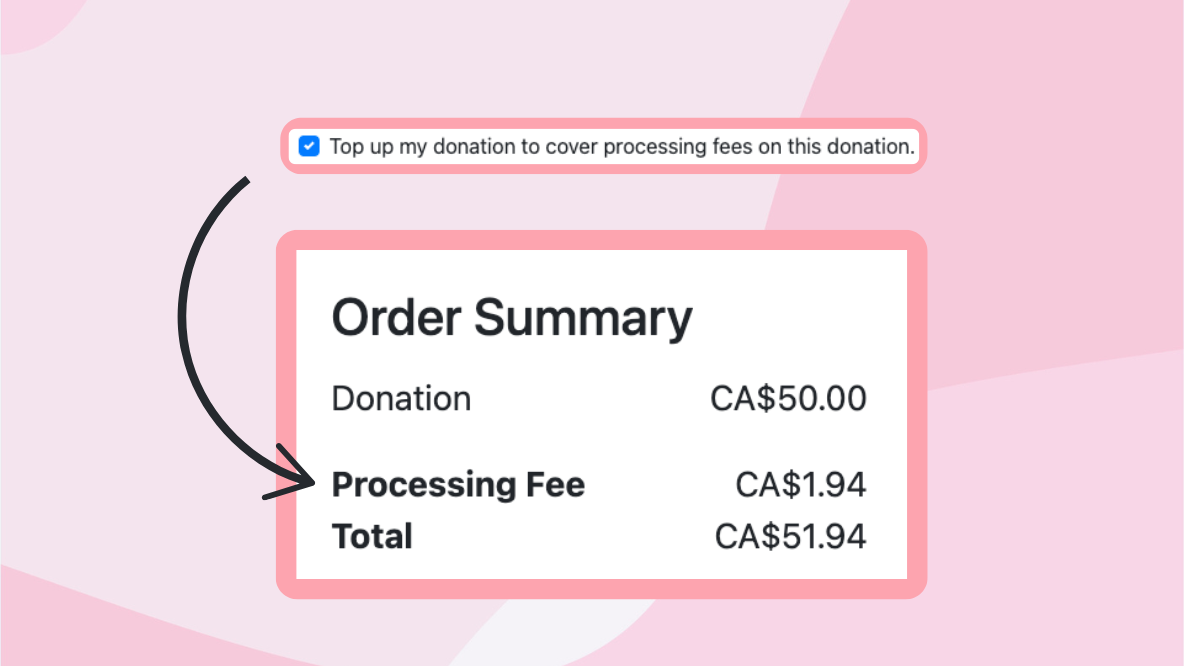

Let donors cover processing fees — 92% say yes

Credit card processing fees can eat into your donation revenue. Communal gives donors the option to cover these fees at checkout, so your organization receives 100% of the intended donation. Over 92% of donors choose to cover fees when given the option.

- Optional fee coverage shown at checkout

- 92% donor opt-in rate when fees are presented

- Your organization receives full donation amount

- Separate tracking of donations vs. fee coverage

Donors access receipts anytime from their portal

No more fielding calls from donors looking for their receipts during tax season. Every donor has access to a self-serve portal where they can view and download all their tax receipts from your organization. Generate year-end summaries for recurring donors automatically.

- Donor self-serve portal for receipt access

- Year-end giving summaries for recurring donors

- Export all receipts for audit or compliance

- Receipts for offline donations (cash, cheque) too

Powering 500+ community organizations

Frequently asked questions

Tax receipts are automatically emailed to donors immediately after their donation is processed. The receipt includes all required information for tax purposes, including your organization's charitable registration number, the donation amount, and the date.

Yes! Communal generates tax receipts that meet Canada Revenue Agency (CRA) requirements for charitable donation receipts. Receipts include all required fields: your organization's name and registration number, the donor's name and address, the donation amount, date, and a unique receipt number.

You can customize tax receipts with your organization's logo and branding. The receipt template includes all required CRA fields while allowing you to add your visual identity for a professional, branded donor experience.

When enabled, donors see an option at checkout to cover the credit card processing fees. If they choose to cover fees, a small amount is added to their donation so your organization receives 100% of the original donation amount. Over 90% of donors choose to cover fees when asked.

Yes! Donors can log into their donor portal to view and download all past tax receipts at any time. This is especially helpful during tax season when donors need to gather their charitable giving records.

Record offline donations like cash or cheques in Communal and the system will generate a tax receipt just like online donations. You can choose to email the receipt to the donor or print it for mailing.

Your data is stored in a secure database that is not accessible to anyone. Users' credit card information is not stored on our platform. We utilize Stripe to process payments, learn more about how they store their data here.

You can! Our team is happy to help migrate data from an excel spreadsheet or an existing platform you utilize today. Contact us for more questions.

Communal directly deposits into your bank account. We do not hold any funds on our platform.

Yes, Communal is fully PCI-DSS compliant as we partner with Stripe as our payment processor. Stripe has been audited by an independent PCI Qualified Security Assessor (QSA) and is certified as a PCI Level 1 Service Provider. Communal does not have access to see or store any credit card data as all transactions are sent directly to Stripe.

See How Communal Works for Your Organization

Get a personalized walkthrough of the features that matter most to you. We'll answer your questions and help you understand if Communal is the right fit.

Most demos are scheduled within 24 hours